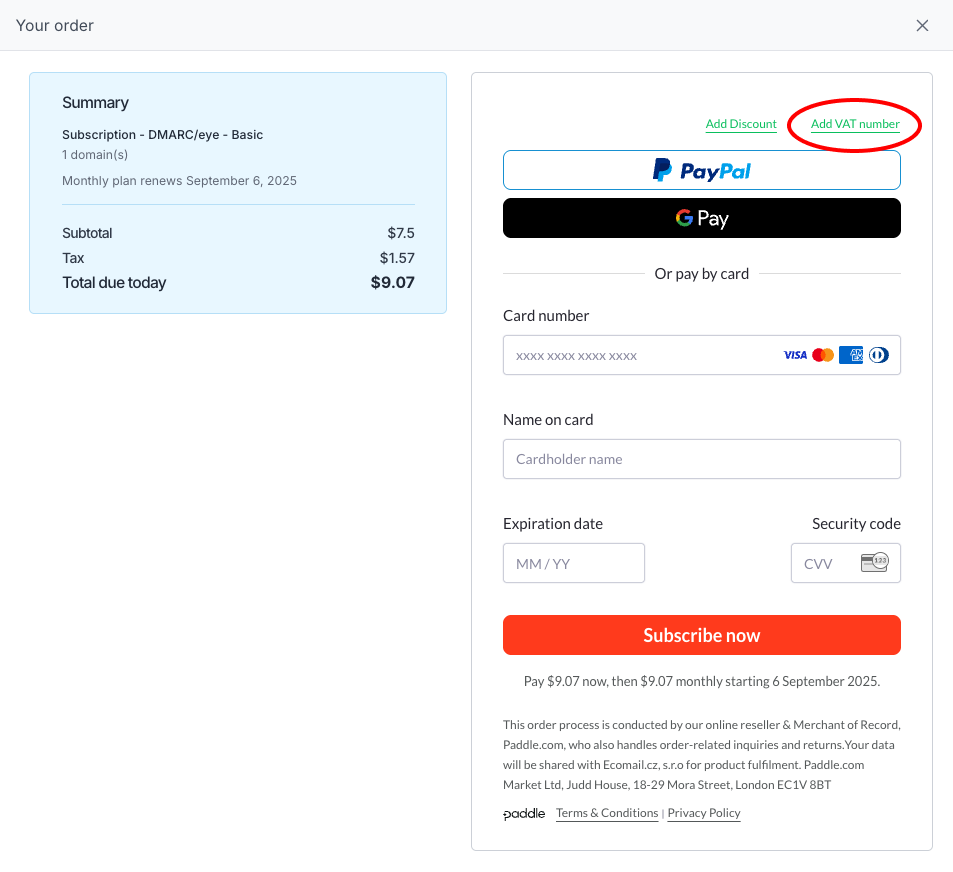

Enter your VAT ID to remove VAT charges when applicable.

If your company is VAT-registered and located in an eligible country, you can enter your VAT ID during checkout to have the VAT (Value Added Tax) removed from your invoice.

During the initial checkout, before completing your payment

The VAT field is shown once you select a billing country where VAT rules apply

Make sure the VAT number is valid and matches your company’s registered details

We cannot retroactively remove VAT from invoices once the payment is completed

VAT validation is handled automatically by our payment processor (Paddle)

If you forget to add your VAT ID at checkout, you will be charged VAT and must resolve any refunds directly via Paddle

If you’re having issues validating your VAT ID or unsure whether VAT applies to your region, feel free to contact us at support@dmarceye.com.